Cryptocurrency markets are

growing exponentially

Crypto VS

Internet

Crypto adoption is accelerating at a historic pace, rivaling the early growth of the internet itself. What started as a niche innovation has evolved into a global movement — reshaping how people think about money, ownership, and digital freedom.

As more individuals, businesses, and even governments embrace blockchain technology, crypto is quickly becoming one of the most transformative forces of our time — redefining the way the world connects, trades, and builds for the future.

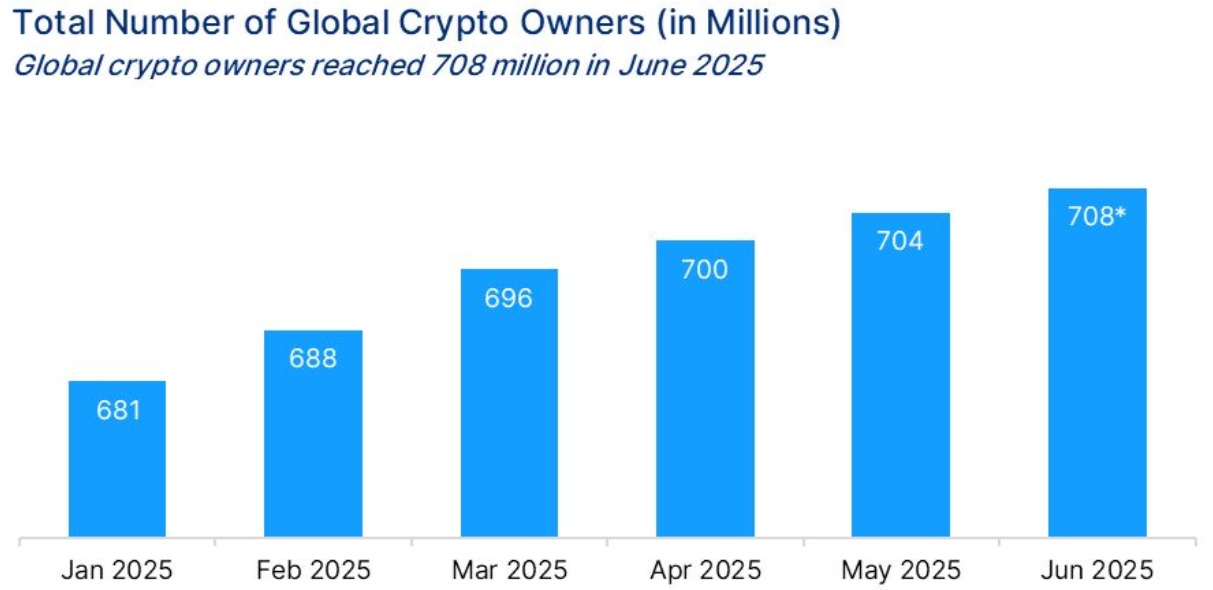

Over half a billion people worldwide now own or use cryptocurrency. From individuals to corporations and governments, crypto adoption is expanding rapidly, signaling a global shift in how value and trust are created in the digital era.

Crypto VS

Other Assets

Cryptocurrency is not just another investment — it’s a new asset class that’s reshaping the financial landscape. Unlike traditional assets such as stocks, bonds, or real estate, crypto offers global accessibility, transparency, and decentralization, giving individuals unprecedented control over their wealth.

While traditional assets are tied to specific markets, countries, or institutions, crypto operates 24/7 across borders, enabling anyone, anywhere, to participate in the digital economy. Its unique blockchain technology ensures security, transparency, and verifiable ownership, features that conventional assets cannot match.

Crypto also offers innovation and growth potential unmatched by most traditional investments. From decentralized finance (DeFi) to non-fungible tokens (NFTs) and digital payment systems, the crypto ecosystem is expanding at a pace that no other asset class has experienced in modern history.

Crypto isn’t just competing with stocks, bonds, or gold — it’s creating a new frontier of financial opportunity, empowering users and investors to rethink what ownership, value, and wealth can mean in the 21st century.

Government recognition of

cryptocurrencies

Institutional recognitions of

cryptocurrencies

Cryptocurrencies are now firmly on the radar of the world’s largest financial institutions. BlackRock has launched Bitcoin and Ethereum ETFs and is now pursuing ETFs for other major altcoins. PayPal has rolled out its stablecoin PYUSD, JPMorgan links bank accounts directly to Coinbase wallets, and SWIFT is integrating blockchain for faster cross-border payments. Crypto is no longer a niche asset — it’s becoming a core part of the global financial system, unlocking unprecedented opportunities for investors and businesses worldwide.

Payment providers integration

to blockchain

Cryptocurrencies are no longer just an investment — they are becoming a core part of the global payments ecosystem, reshaping how money moves across borders and how businesses and individuals transact. Mastercard and VISA are integrating blockchain and stablecoins into their networks, making payments faster, cheaper, and more transparent than ever.

Platforms like PayPal, Stripe, and Square are bringing crypto to everyday users and merchants, enabling seamless payments, transfers, and conversions between fiat and digital currencies. Even SWIFT is adopting blockchain technology to support real-time, 24/7 international payments, bridging traditional banking with the efficiency of digital assets. Together, these developments show that crypto is reshaping the financial system, creating a more inclusive, efficient, and borderless global economy.

Cryptocurrency is ideal as a

cross-border payment rail

A global layer of interoperability.

Global Payment

Revenue

Global and digital services

need global payments rail

E-Commerce

+4.3T USD

Gaming

+250B USD

Aviation

+800B USD

Media

+200B USD

Remittances

+500B USD

Art

+50B USD

Did you

know?

You can purchase real estate in Dubai with cryptocurrencies. Online shopping from major eCommerce brands such as Amazon, Walmart and eBay. Booking flights, hotels and activities.

The last Bitcoin will be mined in 2140. An estimated of 20% Bitcoin has been lost forever. A pizza purchase was the first commercial Bitcoin transaction.